1998 Report on e-Commerce Predicts the Future of AI-Generated Retail Media

A look back at a 1998 E-Commerce Report that delivers a wake-up call for the future of AI-driven commerce

In 1998, The Myers Report published E-Commerce: The Electronic Marketing Future, co-written by Jack Myers and then–senior editor Joe Mandese. At the time, the internet was just beginning to transform commerce, and e-commerce sales in the United States were measured in millions, not trillions. Amazon was still primarily a bookseller, Dell was pioneering direct-to-consumer PC sales, and terms like “mass customization” and “disintermediation” were just entering the marketing vocabulary.

Today, e-commerce is a $6.3 trillion global market (2024, eMarketer), representing more than 20% of all retail sales worldwide. The strategic imperatives Myers and Mandese identified more than 25 years ago have not only been validated, they’ve been amplified. Now, with generative AI accelerating faster than any prior technology in human history, the next upheaval in consumer marketing could dwarf even the internet’s disruption.

This Back-to-the-Future analysis revisits the 1998 report’s insights, compares them with the realities of today’s marketplace, and projects how AI will reshape e-commerce in the decade ahead.

Then and Now: Core Predictions That Came True

The 1998 report foresaw two competing visions for e-commerce:

Utopian: A world of mass customization, where marketers deliver products literally to order, boosting consumer satisfaction, brand loyalty, and corporate profitability through zero-inventory and no-return models.

Chaotic: A commoditized marketplace where brand value erodes, price becomes the primary differentiator, and small and large marketers alike compete for attention in an open bidding war.

Both scenarios have played out, often within the same platform. Amazon, Shopify, Temu, and Shein deliver mass customization and hyper-efficient logistics, yet also contribute to intense price-driven competition. The report’s observation that “size definitely does not matter” has proven prescient: niche direct-to-consumer brands can scale globally almost overnight through targeted advertising, social media, and marketplace integrations.

What came true:

Disintermediation: The report predicted traditional intermediaries would be cut out as digital platforms connected producers directly to consumers. Today’s DTC brands, creator-driven commerce, and influencer storefronts are direct descendants of this trend.

Customer control: Consumers now expect price transparency, comparison tools, and near-instant delivery - the “immediacy” Myers highlighted as redefining brand loyalty.

Cross-category disruption: In 1998, sectors like auto retailing and travel were already feeling early e-commerce effects. Today, virtually every retail category is touched, from groceries to luxury fashion.

Key Examples from 1998: Historical Markers of a Shift

The report cited examples that, in hindsight, were early signals of a seismic transformation:

Auto-by-Tel: $1.8 billion in new car sales through web leads in 1996–97, proof that big-ticket items could be sold online or heavily influenced by digital research.

Dell Computers: $6 million in daily sales by the end of 1997, an early master of build-to-order e-commerce.

Amazon.com: Less than $16 million in 1996 revenue, but already a threat to Barnes & Noble, which launched its own online store in 1997.

These companies’ strategies - direct engagement, inventory efficiency, and a relentless focus on user experience - are now table stakes.

Source: Morgan Stanley, The Myers Report

The Speed of Adoption: Then vs. Now

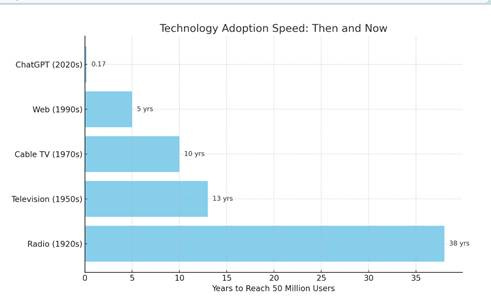

One of the report’s most striking data points was the time to 50 million users:

Radio: 38 years

Television: 13 years

Cable TV: 10 years

Web: 5 years

Today, ChatGPT reached 100 million users in just two months, a rate of adoption that outpaces every prior media or technology platform. This acceleration matters because the next major disruption in e-commerce will be AI-native commerce, where search, selection, personalization, and even negotiation are handled by AI agents.

Just as early e-commerce eliminated physical friction (location, hours, inventory limits), AI is poised to remove cognitive friction: the effort consumers expend in finding, comparing, and deciding.

Then and Now: The Economics of E-Commerce

Subscribers can scroll down to continue reading and for detailed data, insights, and recommendations. The Myers Report economic insights and subscriber-only reports are the exclusive source of funding for our continued commitment to delivering value, insights, and context for the technointelligence transformation. Subscribe — free or paid — to support my work and to continue to the updated economic data and insights that follow in this report, available only to subscribers. Shared below for subscribers is a chart on AI Projected Milestones ahead, 1998 e-commerce economic forecasts compared to 2024 realities of e-commerce sales, lessons on e-commerce from 1998 that still matter for future planning and projections, economic implications, and recommendations for all those whose business depends on e-commerce.

Keep reading with a 7-day free trial

Subscribe to The Myers Report to keep reading this post and get 7 days of free access to the full post archives.